Estate planning—the process for how you transfer your wealth to heirs and others—can be very important for anyone who wants to be certain that their loved ones are adequately provided for and taken care of. When done well, estate planning aims both to allow you to pass on your assets as you see fit, and to minimize the state and federal tax bite that often accompanies the transfer of significant wealth.

Even if you are not subject to estate taxes or don’t have family, estate planning can potentially enable you to decide which people and charitable organizations will receive your wealth at your death. Failing to plan can mean that you will let the government make those decisions—and we find that few people are fond of that choice!

But if you think that your current estate plan is up to those tasks, you might want to think again. Here’s why your estate plan may need to be refreshed.

Read our guide: Pursuing your financial goals with a Financial Advisor in Nashville

Most estate plans are old—and potentially outdated

First, some good news: Eight out of ten affluent individuals (those with investable assets of $500,000 or more) in one survey by AES Nation had some sort of estate plan in place.

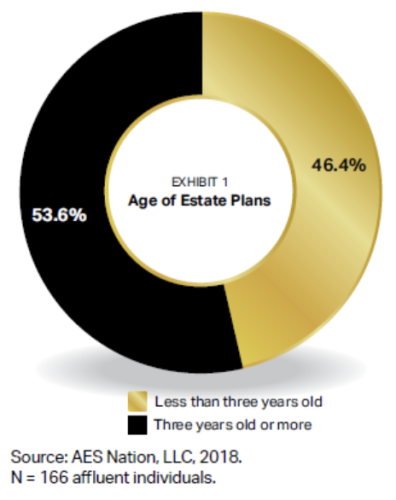

Here’s the less sanguine news: Even if you have an estate plan, you may not be nearly as well prepared as you think you are for transferring wealth according to your wishes. That’s because more than half of the estate plans these affluent individuals have in place are more than three years old (see Exhibit 1).

Here’s why that’s a big deal—one that should raise a red flag that your plan could be outdated:

- Continual changes in tax laws mean that older estate plans may not take full advantage of current opportunities to transfer assets optimally.*

- Tax law changes also could mean that some aspects of an older estate plan are no longer effective.*

- Changes in your wealth status mean that your estate plan may no longer accurately reflect your financial situation—and your future needs and goals.

- Changes in your personal and family situation may make your estate plan ineffective in accomplishing what you actually want it to do given those changes.

* A tax professional should be consulted on all tax-related issues.

ESTATE PLANNING UNCERTAINTY ABOUNDS FOR MANY

In order to attain the greatest benefits from estate planning, it’s a good idea to stay on top of your plan and revise it when appropriate—especially when new events occur that potentially affect your wealth.

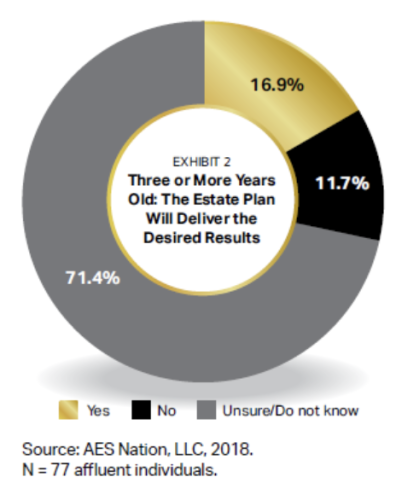

Having an old estate plan can potentially create uncertainty in a key area of managing your wealth. Example: The vast majority of individuals—71.4 percent—with estate plans that were three or more years old said they did not know whether their plan would deliver the results they wanted, according to AES Nation (see Exhibit 2). Just 17 percent of this group said they were confident their plan would deliver the results they wanted. And a little more than 10 percent said it would not perform as desired.

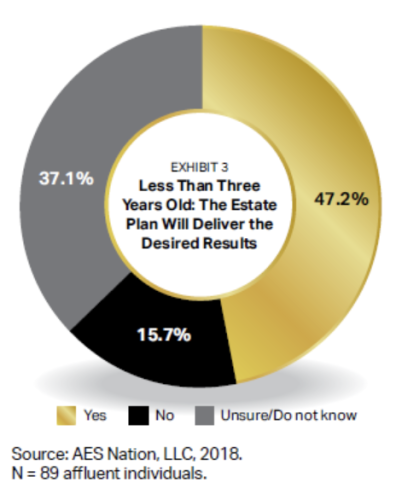

In contrast, an updated plan can potentially provide a sense of confidence. Consider the individuals with plans that were less than three years old: Nearly half said they knew their plan would deliver the results they want (see Exhibit 3). About 15 percent said that their plan needs to be revised because it would not deliver the desired results. Fewer than 40 percent did not know or were unsure about how their plan would perform.

Those results are much better than the results of the group with the older plans—but the AES Nation data shows that a large percentage of people from both groups are uncertain about the effectiveness of their plan.

Next steps to consider

The messages from these findings that should be considered are:

- Have an estate plan in place if you want a say in where your wealth goes after you’re gone.

- Don’t let your plan gather dust in a binder, folder or drawer (or in the cloud, for that matter).

Your next step: If you already have an estate plan set up, you might want to stress test it to see if it is still positioned to achieve your specific wealth transfer goals (especially given some of the tax law changes in recent years). By stress testing the plan, you can assess the outcomes it would likely deliver under various scenarios that could potentially occur. Many families regularly use stress testing to evaluate their existing strategies as well as strategies they are considering implementing.*

*A tax professional should be consulted on all tax-related issues.

ACKNOWLEDGMENT: This article was published by the VFO Inner Circle, a global financial concierge group working with affluent individuals and families, and is distributed with its permission. Copyright 2023 by AES Nation, LLC.

This article was written by CEG Worldwide and not the presenting representative or the representative’s broker/dealer and should not be construed as investment advice. CEG Worldwide is not affiliated with the representative, Mitch Silberman, or Cetera.

This report is intended to be used for educational purposes only and does not constitute a solicitation to purchase any security or advisory services. Past performance is no guarantee of future results. An investment in any security involves significant risks and any investment may lose value. Refer to all risk disclosures related to each security product carefully before investing. Advisory Services offered through Silberman Wealth Strategies, Inc., Mitch Silberman (CA Insurance License #0B24856) Registered Principal of and securities and advisory services offered through Cetera Advisor Networks LLC (doing insurance business in CA as CFGAN Insurance Agency LLC – CA Insurance License #0644976), member FINRA/SIPC, a broker/dealer and Registered Investment Advisor. Cetera is under separate ownership from any other named entity. Mitch Silberman and Silberman Wealth Strategies, Inc., are not affiliated with AES Nation, LLC. AES Nation, LLC is the creator and publisher of the VFO Inner Circle Flash Report.

The views stated in this piece are not necessarily the opinion of Cetera Advisor Networks LLC and should not be construed directly or indirectly as an offer to buy or sell any securities. Due to volatility within the markets, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results. Cetera does not offer direct investments in commodities.

Registered Representative offering securities and advisory services through Cetera Advisor Networks LLC, member FINRA/SIPC, a broker/dealer and Registered Investment Adviser. Advisory services also offered through SILBERMAN WEALTH STRATEGIES, INC. Cetera is under separate ownership from any other named entity. Located at 320 SEVEN SPRINGS WAY STE 250, BRENTWOOD, TN 37027

For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera Advisor Networks LLC nor any of its representatives may give legal or tax advice. All investing involves risk, including the possible loss of principal. There is no assurance that any investment strategy will be successful. Some IRA’s have contribution limitations and tax consequences for early withdrawals. For complete details, consult your tax advisor or attorney. Distributions from traditional IRA’s and employer sponsored retirement plans are taxed as ordinary income and, if taken prior to reaching age 59 ½, may be subject to an additional 10% IRS tax penalty. A diversified portfolio does not assure a profit or protect against loss in a declining market.