When was the last time you took a close look at your estate plan? It’s not uncommon for even the most well-thought-out estate plans to become outdated as personal circumstances evolve and economic conditions and laws change.

As a Nashville wealth advisor, I help successful individuals and families with the intricacies of managing significant wealth. This includes a thorough review of existing estate plans.

Your estate plan should be fashioned in a way that allows you to transfer wealth to your loved ones and the causes you care deeply about. Taking this important step gives you what I like to call ‘control from heaven’. In addition, failing to plan in a tax-efficient manner can mean that your heirs may pay more to the government, which is not high on most people’s priority list!

Signs Your Estate Plan Needs to be Updated

First, some good news: Eight out of ten affluent individuals (those with investable assets of $500,000 or more) in one survey by AES Nation had some sort of estate plan in place.

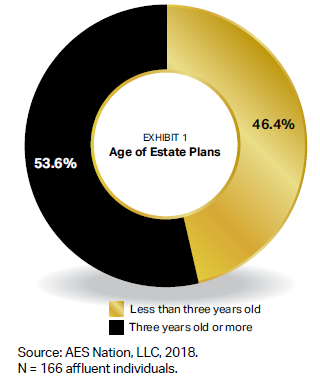

Here’s the not-so-good news. Even if you have an estate plan, you may not be nearly as prepared as you think for transferring wealth according to your wishes. That’s because more than half of the estate plans these affluent individuals have are over three years old (see Exhibit 1).

Most estate plans are old and potentially outdated. Here’s why that’s a big deal—one that should raise a red flag that your plan could be outdated:

- Continual changes in tax laws mean that older estate plans may not take full advantage of current opportunities to transfer assets optimally. *

- Tax law changes also could mean that some aspects of an older estate plan are no longer effective. *

- Changes in your wealth status mean that your estate plan may no longer accurately reflect your financial situation and future needs and goals.

- Changes in your personal and family situation may make your estate plan ineffective in accomplishing what you want it to do, given those changes.

* A tax professional should be consulted on all tax-related issues.

Many Face Uncertainty in Estate Planning

To maximize the benefits of estate planning, it’s a good idea to stay on top of your plan and revise it when appropriate, especially when new events potentially affect your wealth.

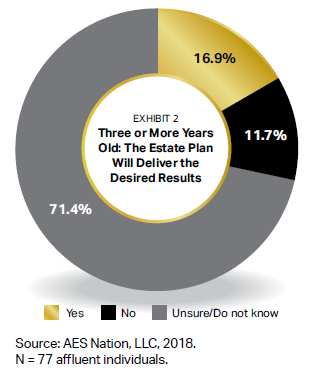

Having an old estate plan can potentially create uncertainty about the management and distribution of your wealth, in accordance with your goals and wishes.

As an example: The vast majority of individuals, 71.4 percent, with estate plans that were three or more years old, said they did not know whether their plan would deliver the results they wanted, according to AES Nation (see Exhibit 2). Just 17 percent of this group said they were confident their plan would deliver the desired results. And a little more than 10 percent said it would not perform as desired.

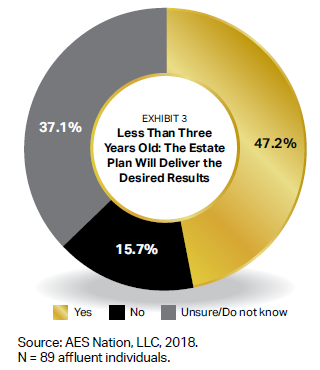

In contrast, an updated plan can potentially provide a sense of confidence. Consider the individuals with estate plans that were less than three years old: Nearly half said they knew their plan would deliver the results they wanted (see Exhibit 3). About 15 percent said their plan needs to be revised because it would not deliver the desired results. Fewer than 40 percent did not know or were unsure how their plan would perform.

Those results are much better than the results of the group with the older plans—but the AES Nation data shows that a large percentage of people from both groups are uncertain about the effectiveness of their plan.

How to Update Your Estate Plan

The takeaway from these findings that should be considered are:

Having an estate plan is crucial if you want a say in who inherits your financial wealth (control from heaven).

An estate plan should not be a “set-it-and-forget-it” document. It should be a living document that is reviewed and updated regularly. Don’t let your plan gather dust in a binder, folder, or drawer (or in the cloud, for that matter).

If you already have an estate plan, you should stress test it to see if it is still positioned to achieve your wealth transfer goals (especially given some of the tax law changes in recent years in addition to the sunset provisions already schedule to take place on January 1, 2026).

By stress-testing your plan, you can assess the outcomes it would likely deliver under various scenarios that could occur. Many families regularly use stress-testing to evaluate their existing strategies and strategies they consider implementing. *

*A tax professional should be consulted on all tax-related issues.

About Silberman Wealth Strategies

At Silberman Wealth Strategies, our services are modeled around the responsibilities that a Chief Financial Officer has within a business.

We believe that the business of your family’s finances benefits from having a Personal Chief Financial Officer, a professional who understands your and your family’s financial needs.

As your Nashville Personal Chief Financial Officer, we provide Personal CFO services for a select group of successful individuals and families. Our overarching goal is helping you preserve wealth and pursue your financial goals, ultimately helping you live an amazing life of significance.

ACKNOWLEDGMENT: This article was published by the VFO Inner Circle, a global financial concierge group working with affluent individuals and families, and is distributed with its permission. Copyright 2023 by AES Nation, LLC.

This report is intended to be used for educational purposes only and does not constitute a solicitation to purchase any security or advisory services. Past performance is no guarantee of future results. An investment in any security involves significant risks, and any investment may lose value. Refer to all risk disclosures related to each security product carefully before investing. Mitch Silberman is a registered representative offering securities and advisory services through Cetera Advisor Networks LLC, member FINRA/SIPC, a broker/

dealer and registered investment adviser. Advisory Services offered through Silberman Wealth Strategies, Inc. Cetera is under separate ownership from any other named entity. Mitch Silberman and Silberman Wealth Strategies, Inc. are not affiliated with AES Nation, LLC. AES Nation, LLC is the creator and publisher of the VFO Inner Circle Flash Report.

For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera Advisor Networks LLC nor any of its representatives may give legal or tax advice.